WE OFFER MANY SERVICES TO SUPPORT YOUR NEEDS

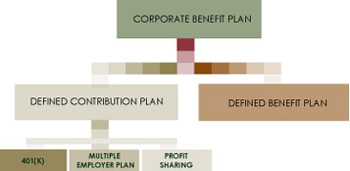

CORPORATE BENEFIT PLANS

At a time when employee demographics and expectations are shifting rapidly, we assist corporate clients with a broad range of pension, healthcare, and employee communications issues.

DEFINED CONTRIBUTION PLANS

OMNI designs plans that meet the specific goals of sponsors, such as maximizing contributions to valued employees or encouraging full participation. Primarily focused on 401(k) plans, we also have broad experience in the design of profit sharing, money purchase, defined benefit, ESOP, and nonqualified, as well as 403(b) and 457 plans.

401(k)

401(k) plans allow employees to elect or receive current compensation or have part of their compensation contributed to a corporate benefit plan or stock bonus plan on a pre-tax basis. Rollovers and employer match are additional features available.

PROFIT SHARING

The employer deduction limit is 25% of total compensation paid to plan participants exclusive of 401(k) salary deferrals.

MULTIPLE EMPLOYER PLANS

With increases in corporate mergers and changes in demographics and retirement patterns, we understand the importance of designing plans that meet participants' needs in a cost-effective manner.

COMPLIANCE & REPORTING

With the IRS and Department of Labor increasing retirement plan audit activity, it is essential for sponsors to self-audit to assure compliance. Our consultants conduct periodic compliance testing to ascertain whether your plan satisfies all prescribed nondiscrimination tests. At the same time, we prepare governmental filings and provide independent auditors with the data they need to conduct annual financial audits.

FUNDING & FINANCE

Using state-of-the-art technology, OMNI greatly shortens the time needed to analyze the effect of changes in contribution rates, actuarial assumptions and demographics on plan performance. Our models can be used to project the future funded status of defined benefit plans under a variety of economic scenarios.

PAYCHECK ILLUSTRATOR

OMNI's software product is designed to supplement written benefits communications and respond directly to employee requests for personalized retirement planning. Using powerful graphics, the Paycheck Illustrator helps employees see where retirement income shortfalls exist and how choices made today affect the future.